How Mortgage Loans Work

Learn about the components of a mortgage, who is involved, and gain clarity on this major milestone in your life.

By Kevin Runyon

Buying a home is a major milestone in many people’s lives. However, that doesn’t mean the process is clear to those people. The home buying process involves many steps and variables, meaning each person’s experience will be unique to their family, financial situation, and desired property. But that doesn’t mean we can’t help make sense of the mortgage process. Below, we outline the basics of what a mortgage is, the components of a mortgage, and who is involved in the process.

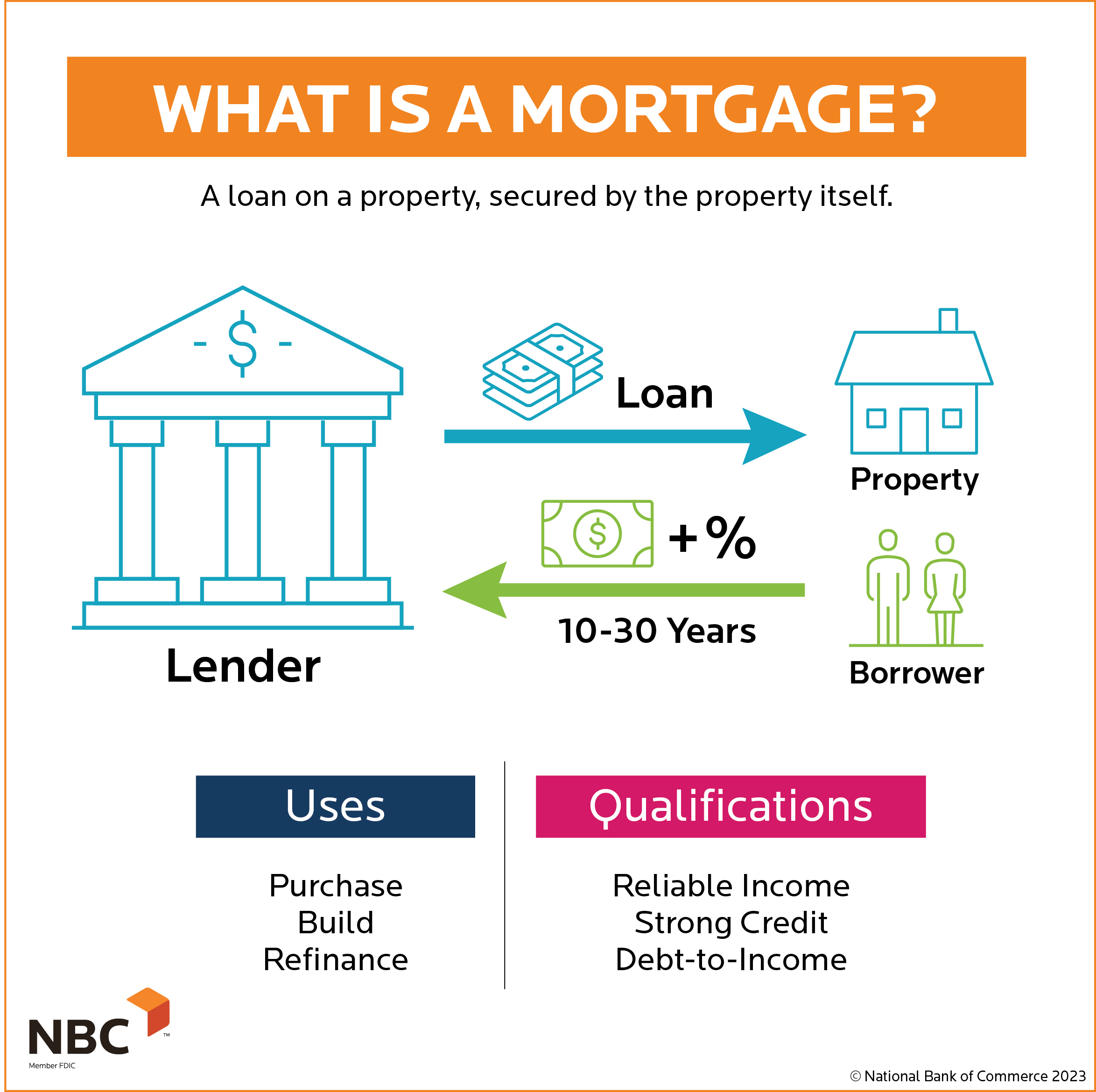

What Is A Mortgage?

A mortgage is a type of loan you use to buy property, such as a home.

A financial institution or “lender” will give you money and they will require you to use the home as collateral. This is called a secured loan.

Typically, a lender will give you a set amount of money based on the value of the home you want to buy or own. You agree to make payments over an agreed-upon period until the loan is repaid in full.

Who Can Get a Mortgage?

To qualify for a mortgage loan, you will need to be at least 18 years old. Factors that help in the mortgage process are a reliable income source, a strong credit score, and a modest debt-to-income ratio.

» You’ll learn more about these factors in Module 2: How Much Can I Afford?

Mortgage vs. Mortgage Refinance

A mortgage refinance is when the homeowner gets a new mortgage loan to replace the one they currently have in place.

The homeowner can use the same house that was on the first loan for the new refinance loan. Homeowners usually refinance for a few reasons, including lower interest rates, lower payments, or to get access to the cash or equity they have available from paying down their original mortgage or from the increase in their home’s value over time.

How Many Mortgages Can I Have on My Home?

Many lenders allow you to have up to two mortgage loans on your home. The second loan is usually a home equity loan or a home equity line of credit (HELOC).

A home equity loan functions similarly to a first mortgage. You can borrow a fixed amount of money based on your home’s equity, and pay it off through fixed monthly payments over a set term.

A HELOC operates a bit differently from a traditional mortgage loan and is similar to a credit card. With a HELOC, you receive approval for a fixed amount of money and have the flexibility to borrow what you need as you need it. They are repaid with interest, but typically have a lower annual percentage rate (APR) than other types of credit, like consumer credit cards.

To learn more about these two lending products, see: Type of Mortgages

Parties Involved

Lender

The financial institution or mortgage company that helps you obtain your mortgage loan and provides you with the money to buy your home is known as the lender.

Borrower

The borrower is the person getting the mortgage loan, typically the future homeowner, and is responsible for making all the payments.

Co-signer

A person may be asked to help a borrower qualify for a mortgage if the borrower doesn’t qualify on their own. This co-signer will agree to make payments on the mortgage if the borrower does not pay as agreed.

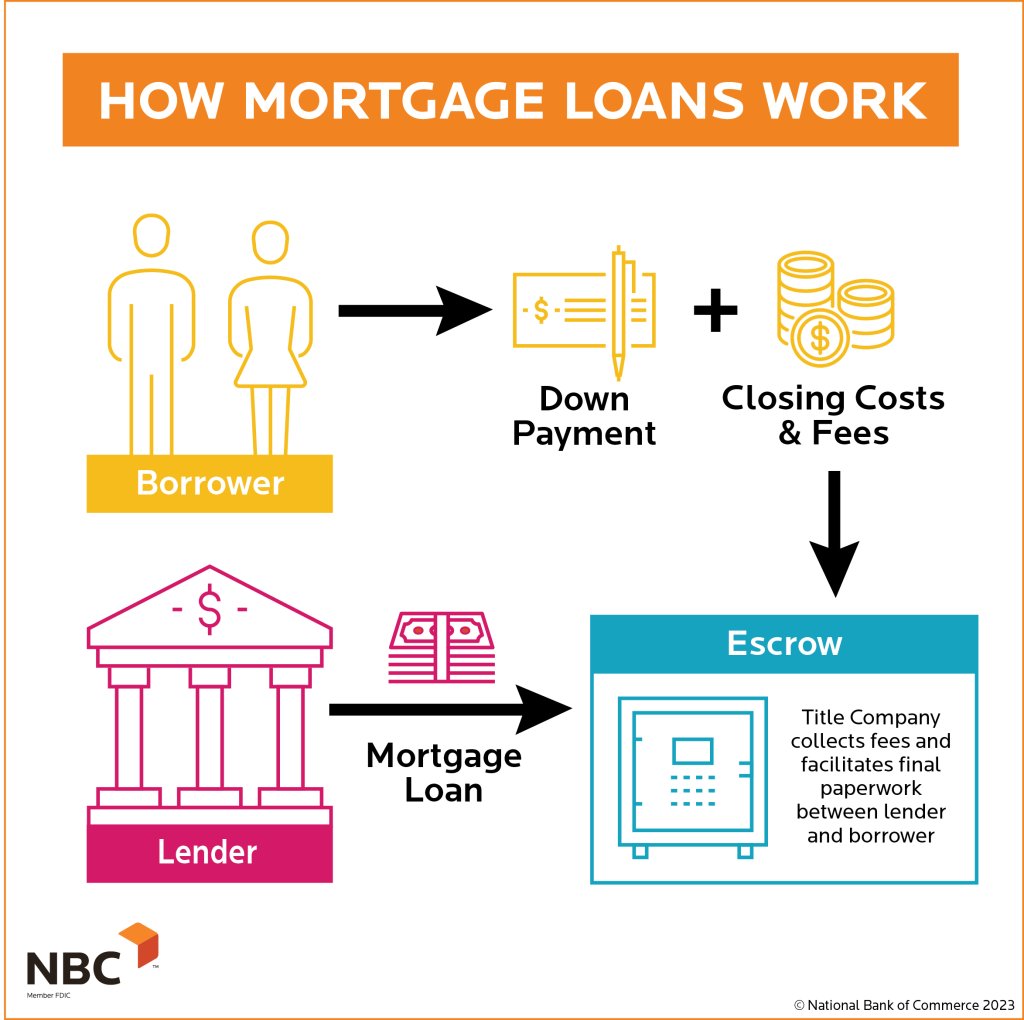

Title Company

Title companies play a crucial role ensuring the smooth transfer of property ownership. They research state and county records to confirm the “title”, or ownership of the house being purchased, is free and clear of any other mortgages or obligations.

In other words, they make sure no one else has rights to the property—and that it can be used as collateral to cover the mortgage balance if the borrower does not pay.

Additionally, they provide written assurance to the lending institution and create all the paperwork required for the mortgage loan.

Mortgage Components

Down Payment

A down payment is the amount of cash you must pay upfront towards the purchase of your home.

For example, if you are buying a home for $100,000 the lender may ask you for a down payment of 5%, which means you would be required to have $5,000 in cash as the down payment to buy the home. Your mortgage loan would then be for $95,000, which is the purchase price of the home minus the down payment.

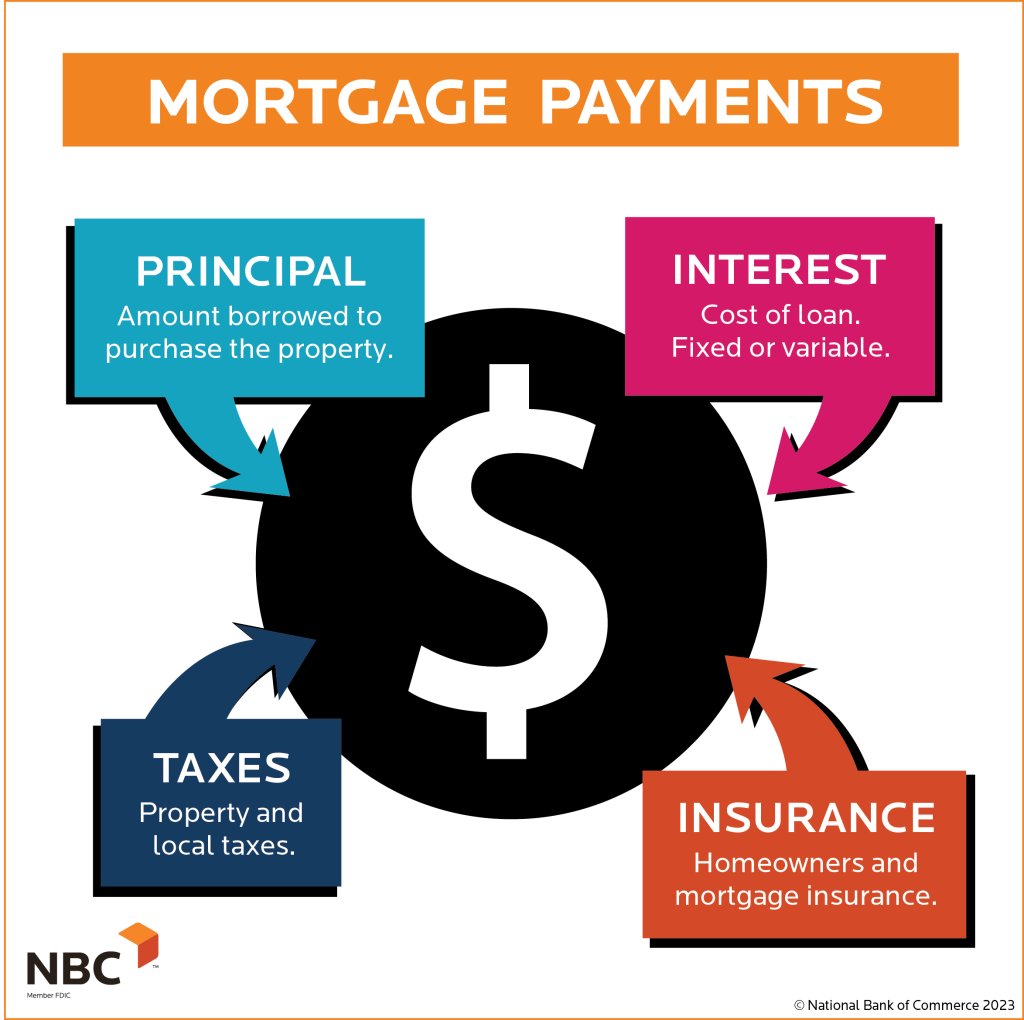

Principal

The principal is the amount of money you receive from the lender to buy the home.

In the above example, $95,000 would be the amount of principal.

Most lenders have conventional mortgage guidelines that allow you to borrow a certain percentage of the value of the home. The percentage of principal you can borrow will differ based on the mortgage program you qualify for. In most cases, a traditional mortgage product will require 20% down and allow you to borrow 80% of the value.

There are special programs for first-time home buyers, veterans, and low-income borrowers that permit lower down payments and higher percentages of principal. A mortgage banker can review these options with you to see if you qualify at the time of application.

Interest

Interest is what the lender charges you to borrow the money to buy the home.

Let’s say that the lender charged you an interest rate of 7%.

If you were to take out a 30-year (360 months) mortgage loan and borrow that same $95,000 from the above example, the total amount of interest you would pay, if you made all 360 monthly payments, would be a little over $32,000. Your monthly payment for this loan would be $632.

A portion of this payment goes toward your principal amount ($95,000) and some toward interest ($32,000).

Taxes

When you own a home or property you will have to pay property taxes to the county where the home is located. Most lenders will require you to pay your taxes with your mortgage payment.

Property taxes on a $100,000 loan could be around $1,000 a year. The lender will divide the $1,000 by 12 months and add it to your payment. This would equate to $83.33 a month. Your monthly payment with taxes included would then be $632.00 + $83.33, for a total payment of $715.33.

The lender keeps this monthly $83.33 tax payment in a holding account called an “escrow” account.

Escrow

This is the separate account your lender sets up to hold your monthly property tax and homeowner’s insurance payments.

The lender pays your property taxes for you twice a year when they are due, using the funds from the escrow account. Since they are paying it and in control, this is beneficial to the lender, as they are assured that their “collateral” is not at risk for non-payment of taxes.

This is also beneficial for the homeowner because it allows them to budget the taxes monthly but not have to pay it all in one lump sum of $1,000, or twice a year as many counties require ($500).

Insurance

Lenders will require the homeowner to have appropriate insurance coverage on their home. Again, because the home is seen as collateral by the lender, they want to make sure it’s protected. Homeowners will be required to provide a copy of the insurance policy to the lender.

The annual insurance policy for a $100,000 home will cost roughly $1,200 a year.

Like taxes, the lender will also offer—or sometimes require—you to include your insurance premium in your monthly payment.

In our example, $1,200 a year divided by 12 months would be $100 a month. Your payment now would increase by $100 to a new total of $815.33—$600 in principle, $32 in interest, $83.33 in taxes, and $100 in insurance.

The lender holds this money in the same escrow account as your property taxes and makes payments to the insurance company on your behalf.

Closing Costs

Closing costs refer to the expenses associated with processing your loan.

Closing costs can include:

- Appraisal costs to establish the value of your home.

- Title or legal costs incurred for researching or preparing the paperwork for your loan.

- Credit reporting fees for pulling and reviewing your credit report.

These are important to consider when budgeting for your home purchase.

Fees

In addition, lenders traditionally collect fees to offset the expenses associated with providing the mortgage loan.

These fees compensate the bankers or originators who assist with the application and closing process, the personnel who review and underwrite the application, and parties involved with regulatory compliance.

Origination Fees

Origination fees, also known as application fees, can be a fixed amount or a percentage of the loan amount (typically 0.5% to 1%).

For example, an origination fee of 1% for a customer borrowing $100,000 would be $1,000.

Underwriting Fees

If the lender imposes fees for underwriting or processing, they are generally fixed amounts that vary depending on the loan size and/or loan program being used.

By law, closing costs and fees must be disclosed and reviewed with the borrower before the mortgage loan is originated. This ensures you understand the total cost and agree to proceed before the loan is funded.

Key Things to Know When Shopping for a Mortgage

There are many different programs and lenders you can choose from when you’re buying a home and getting a mortgage who can help you navigate what programs or options will work best for you.

A good real estate agent can help you understand what homes are available for purchase and can help you get a fair price that is comfortable for your financial situation. Many financial institutions and real estate agents can help you understand how much money you can spend on a home and what loan amount you will qualify for.

Do some research, but also ask for referrals from your friends and family. Finding the right partners that are a good fit for you can make all the difference.

Other Articles in this Guide

How Much Can I Afford?

Learn how to qualify and determine how much you can afford. Your dream home may be closer than you think!

Types of Mortgages

The most common mortgage types explained. Explore and compare to find the option that best suits your needs.

Mortgage Loan Process

Learn how getting a mortgage loan works and take the first step to financing for your dream home in as little as just 30 days.