Components of a Business Loan

Key Elements Explained

Discover the five major components of a business loan, what each entail, and what you need to consider when applying.

By Chad Curran

While there are many options when it comes to the type of business loan for which you can apply, you don’t need to brace yourself for more complexity when it comes to the actual components.

All business loans essentially have the same principal elements:

- Loan Amount (Principal)

- Collateral

- Down Payment

- Interest & Fees

- Term Length

Here’s what you should know and consider about each.

Loan Amount

The amount you borrow (principal) is the first and perhaps most important part of any business loan. In general, you should come into the process with a number in mind. If you are financing a fixed asset, this number is usually a little easier to land on. However, if you are looking to finance startup costs or working capital, it can be a little more difficult.

In a nutshell, apply for what you need while making sure that your revenue will cover the payment necessary for the loan amount.

A good lender will be able to help you sort through everything that should be considered when it comes to your loan amount. And it’s best to consult with them early on so you fully understand the process and can work through all the considerations with them.

Even if you have a specific amount in mind, the amount you are actually able to borrow will be based largely on the following:

- Collateral

- Cash flow of the business

- Credit history

- Credit score

Of these four elements, the amount you can borrow is most determined by your collateral.

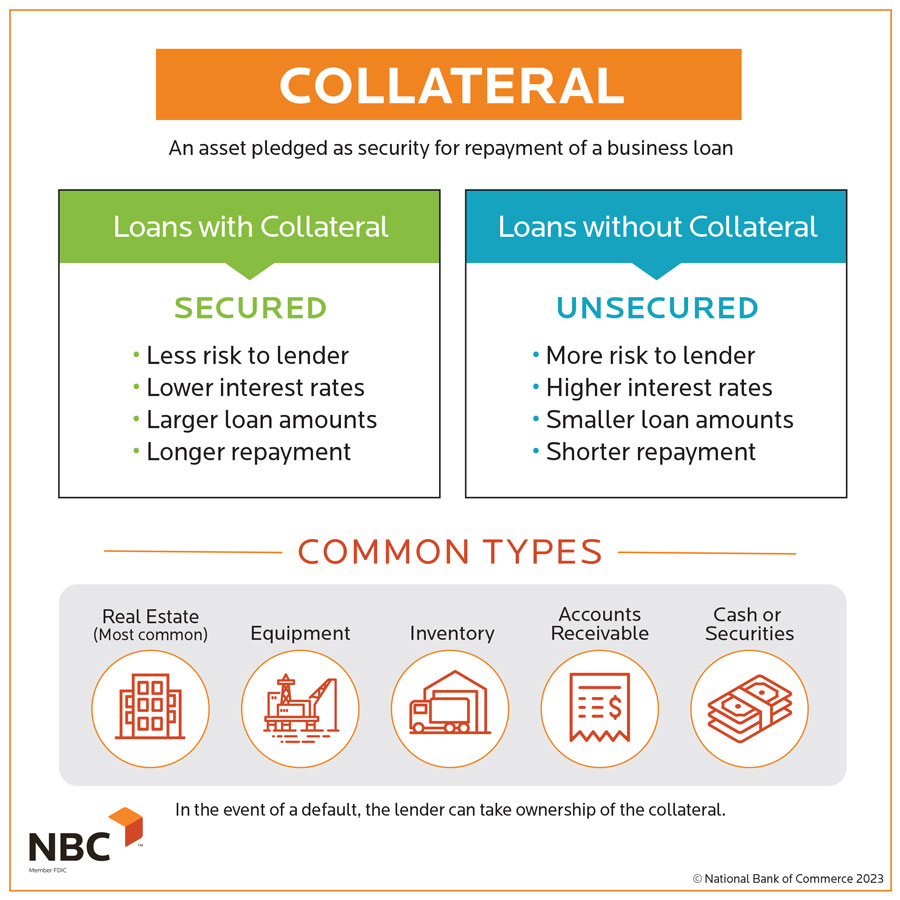

Collateral

Collateral is something of value you (the borrower) own that is pledged to the lender as a guarantee for the loan.

This is what’s known as a “secured” loan. In the event that the loan does not get paid back, the lender can take ownership of the collateral, making the loan less risky for them. The higher the value of the collateral you pledge, the more you’ll likely be able to borrow. Unsecured loans are not backed by any collateral and therefore pose more risk for the lender.

Most business loans require some form of collateral, whether it is an asset of the business or a personal guarantee (wherein an owner of the business acknowledges they will be held personally responsible if the business cannot repay the loan).

Types of collateral include:

- Real estate (most common)

- Equipment

- Inventory

- Accounts receivable

- Cash

The type of collateral required will also vary based on the type of loan. For example, loans used to purchase real estate are secured by the real estate. Working capital or equipment loans can be secured by the equipment, accounts receivable, inventory, etc. Keep in mind, these requirements may differ by lender.

Collateral doesn’t just impact the amount you are able to borrow, it also affects the interest rate you are able to receive on a loan. Ideally, collateral will reduce the risk to the lender, thereby lowering your interest rate.

Cash-secured loans, for example, create very low risk and generally come with the best interest rate.

Down Payment

Down payments are required for most business loans, with the exceptions being secured lines of credit and loans secured by an equal amount of cash as collateral.

A down payment is a percentage of the total loan amount that is paid upfront to reduce the risk to the lender by lowering the overall amount of the loan.

For example, if a bank requires a 20% down payment on a $100,000 purchase, you’ll pay $20,000 up front and the bank will lend you the remaining $80,000.

Down payment requirements typically range from 10-30% (20% being the most common) and vary by loan type.

| Type of Loan | Typical Down Payment |

| Term Loans | 20% |

| Lines of Credit | None |

| Real Estate Loans | 20%-35% |

| SBA 7(a) Loans | 10% |

| SBA 504 Loans | 10%-20% |

| SBA Microloans | 20%-30% |

Other factors for down payments include how the loan will be used, your credit strength, and the value of the collateral pledged.

When considering your business loan options, keep in mind a higher down payment means less risk to the lender and, in general, a lower interest rate resulting in the less you’ll pay over the life of the loan.

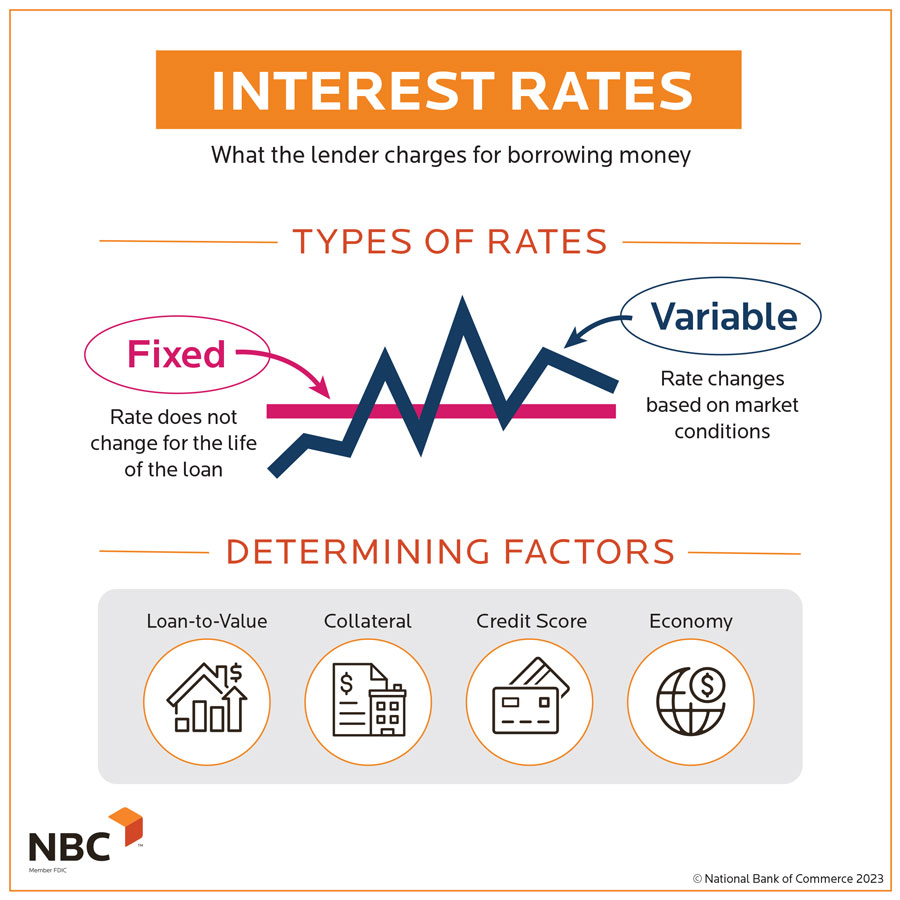

Interest Rates

When applying for a business loan, you should carefully consider the interest rate—the fee that the lender charges for borrowing money.

Types of Interest

The two most common types of interest are:

- Fixed Interest: The interest rate doesn’t fluctuate during the fixed period of the loan.

- Variable Interest: The rate will fluctuate over time based on a reference rate.

| Type of Loan | Typical Interest Type |

| Term Loans | Fixed |

| Lines of Credit | Variable |

| Real Estate Loans | Fixed |

| SBA 7(a) Loans | Variable |

| SBA 504 Loans | Fixed |

| SBA Microloans | Variable |

Interest rates change based on the current state of the U.S. market, inflation, and the U.S. Federal Reserve (which sets the target interest rate commercial banks typically follow).

In addition to this, every lender has its own criteria that factor into the rate for which you will qualify—including loan-to-value ratio, collateral, and credit strength.

The interest rate and type of interest is a discussion that will take place prior to closing on the loan. However, if you’re financing a fixed asset, you’re likely going to want a fixed rate. This is because you want to know what your fixed costs are going to be! If the loan is variable, it is important to understand when the rate can change and by how much.

Other Fees

Many lenders also include some additional fees for processing and servicing your loan, such as an origination and/or documentation fee. Origination fees cover the costs associated with gathering the information necessary to vet the loan request. This is usually a percentage of the loan amount. Documentation fees cover the actual processing of the loan application after approval has been granted.

These fees vary by lender and loan type. For example, lines of credit often don’t require an origination fee due to their short-term nature.

NBC’s origination fee is typically 1% of the loan amount and documentation fees tend to be around $250.

Third-party fees can also be incurred. The most common being appraisals and title work.

Term Length

The term-length, or loan term, is the length of time you have to repay your loan. Ultimately, this is determined by the type of loan.

For example, most fixed-rate term loans can have a term of five, seven, or 10 years, with a five-year term being the most popular. On the other hand, lines of credit are typically done for one year at a time and can be renewed if the business still qualifies.

| Type of Loan | Average Terms |

| Term Loans | 5, 7, or 10 Years |

| Lines of Credit | 1 Year |

| Commercial Real Estate Loans | 15-20 Years |

| SBA 7(a) Loans | 5-10 Years for Working Capital or Equipment, Up to 25 Years for Real Estate or Equipment with a Useful Life Exceeding 10 Years |

| SBA 504 Loans | Up to 10 Years for Equipment, Up to 25 Years for Real Estate |

| SBA Microloans | Up to 6 Years |

What should the borrower consider when it comes to term length?

Essentially, cash flow and rate. The term and amortization of your loan will determine your loan payment. A business needs to find the balance between generating enough income or revenue to cover its operating expenses while still being able to pay back their debt and/or loan payment.

We break down the

components of a loan,

WATCH OUR VIDEO

Conclusion

There are many factors to consider when it comes to a business loan: the amount, the rate of interest you will be charged, the collateral available to pledge, the value of that collateral, and other general terms. It is best to consult a banker early in the process to work through the details and fully understand the process. A banker should be a consultant to help you sort through all that should be considered when it comes to seeking a business loan.

Now that we fully understand the components and types of business lending products, it’s time to discuss how to apply, as well as the documents you’ll need to provide and the steps you’ll need to take to secure your loan. When you’re ready, dive into Module #4, Business Lending Requirements.

Other Articles in this Guide

How Business Loans Work

Learn what business loans are, how to apply for them, how a lender determines how much you can borrow, and how long the process may take.

Types of Business Loans

Learn the differences between term loans, lines of credit and real estate loans, as well as important insights into the other forms of lending available to your business.

Business Lending Requirements

Gain insight into the documents required for a business loan, qualifying (and disqualifying) factors, and even what to do if you’re denied.

You’re Approved, Now What?

Discover what happens after you’re approved for a business loan, what steps you’ll need to take to close, and how funding, payments and annual loan maintenance works.