The 5 Cs (& G) of Credit

Key Factors Used for Business Lending Decisions

Discover what key factors financial institutions take into account when lending to small businesses.

By Scott Bender

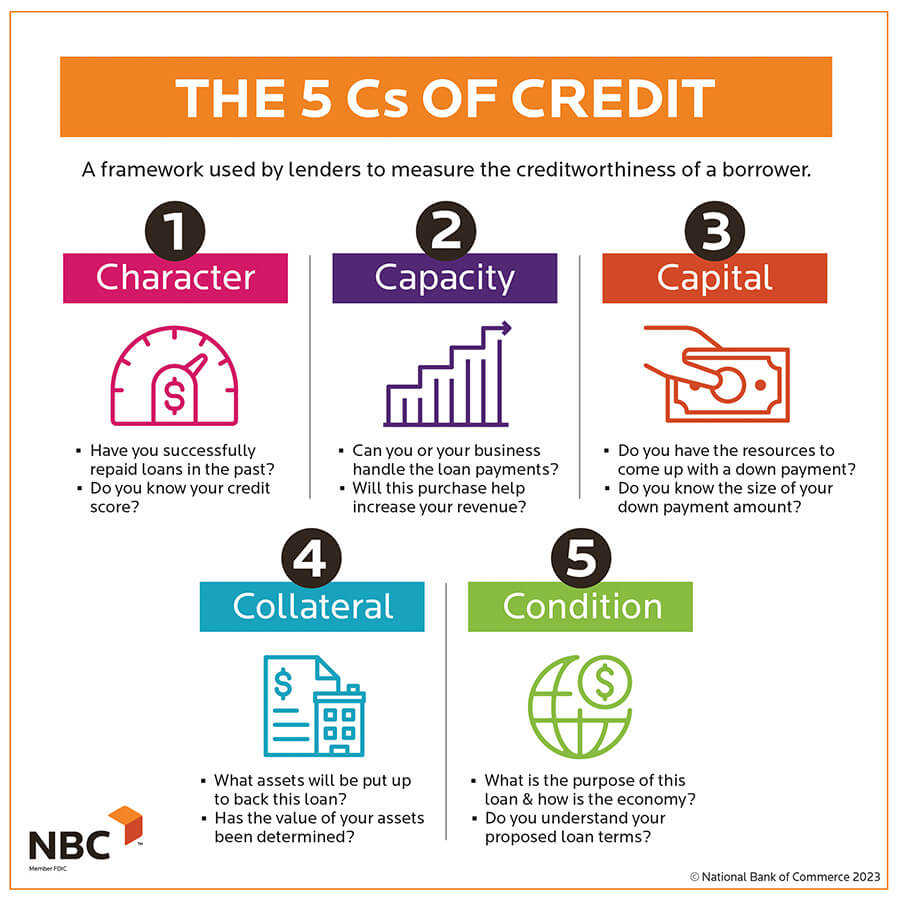

When I think of commercial banking, the first thing that comes to mind are the five Cs of credit: character, capacity, capital, collateral, conditions, and guarantor strength. Okay, I guess the first thing that comes to mind are the five Cs and the G of credit.

I have been in the banking industry for nearly 20 years, starting out as a credit analyst and then moving into a commercial lending role for much of my career. And one thing I learned early is that, no matter the size of the loan, the decision process all comes down to these five Cs … and that single G.

What Are the Five Cs of Credit?

The five Cs of credit are factors that banks and other financial institutions commonly consider when making lending decisions for small businesses.

Again, they are:

- Character

- Capacity

- Capital

- Collateral

- Condition

These factors measure the credit risk of prospective borrowers, both qualitatively and quantitatively. Credit risk refers to the possibility of loss due to a borrower’s failure to repay a loan or satisfy a contractual obligation.

Character

What is Character?

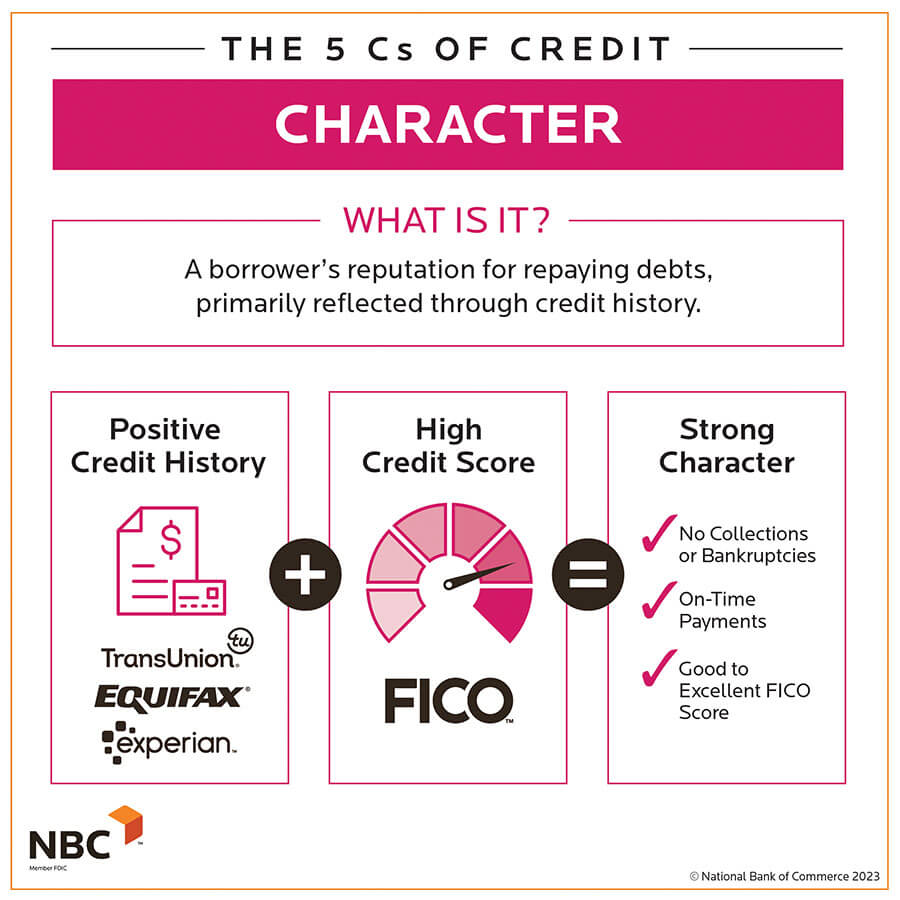

Character, in credit terms, refers to a borrower’s reputation for repaying debts, primarily reflected through credit history.

Credit history, in its simplest form, can be described as the borrower’s reputation or track record for repaying debts. This information typically appears on the borrower’s credit report. A credit report is generated from one of the three major credit bureaus: Equifax, Experian, and TransUnion. Credit reports contain information on how the applicant has borrowed in the past and whether they have repaid their loans in a timely manner.

These reports also include information on collection accounts and bankruptcies, retaining that information for seven to 10 years. A collection account is defined as a credit account that was not paid for as agreed upon and was sent to a collection company to try and recoup the balance on the outstanding debt owed to them.

Credit reports generate a FICO (Fair Isaac Corporation) score with a range of 300-850 and predict the likelihood of an applicant to repay the loan. Many financial institutions require a minimum credit score for loan approval, but the minimum score can vary from place to place.

Financial institutions also rely on credit scores when determining rates and terms on loans. The result is often more attractive rates for borrowers with good to excellent credit versus those with a lower credit score.

One of the ways a borrower can improve their credit score is to consider setting up automatic payments on a credit card and paying them off every month in full to help build their credit score. When a consumer applies for a loan through a bank, the bank pulls their credit report to check a borrower’s creditworthiness. A consumer is allowed one free credit check per year at freecreditreport.com if they want to check on their current credit score.

Capacity

What is Capacity?

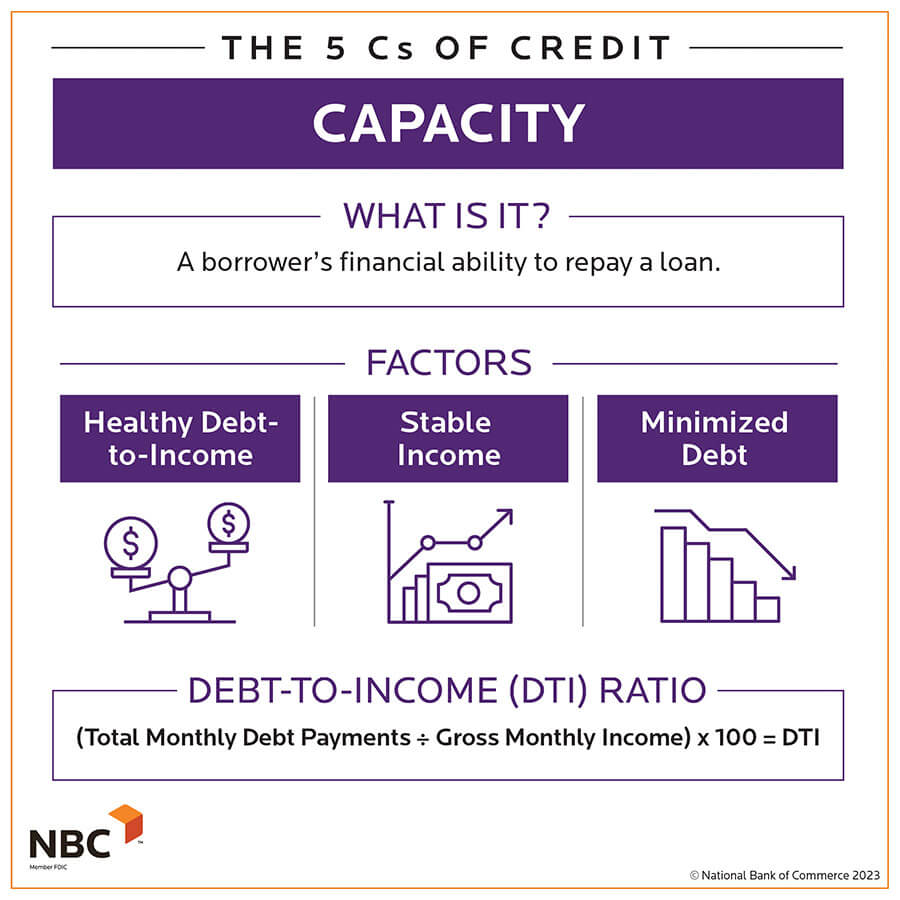

Capacity assesses a borrower’s financial ability to repay a loan, determined by evaluating their debt-to-income (DTI) ratio.

Capacity is measured by comparing their income against recurring debts and by assessing the borrower’s debt-to-income (DTI) ratio. Financial institutions calculate DTI by adding a borrower’s total monthly debt payments and dividing that by the borrower’s gross monthly income. The lower the DTI ratio, the better chance of qualifying for a new loan because it shows that the potential borrower has additional income to spend.

Each financial institution has different thresholds they use when determining whether to approve a new loan based on a borrower’s DTI. For example, a new home mortgage loan typically requires a borrower of a DTI of 43% or lower to qualify. As far as commercial loans are concerned, there is no magic percentage from a DTI perspective, but it is rather determined on a case-by-case basis due to all the other factors involved when evaluating a commercial loan request.

An applicant can improve their capacity by increasing their salary/wage or lowering their overall monthly debt payments. Financial institutions want to see stable income, so switching jobs is not always the best option. Even if the new job brings higher pay, creditors may prefer to see consistent pay on a recurring basis for a longer period of time.

Capital

What is Capital?

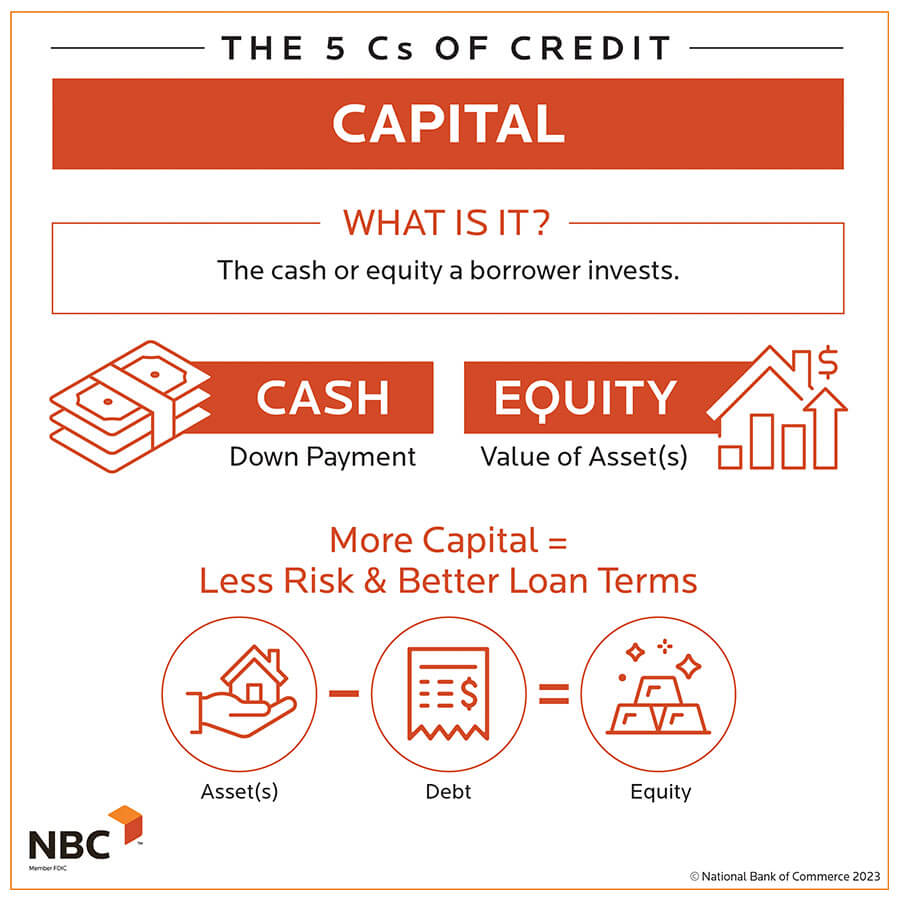

Capital is the amount of cash or equity the borrower puts into a potential investment.

Equity refers to how much an asset is worth minus how much debt is owed (liability) on an asset. A larger capital contribution by the borrower decreases the chance of a potential default.

The amount of capital a borrower can put down on a project can also affect the rates and terms of a borrower’s loan. Larger down payments or capital contributions result in better rates and terms.

Capital is usually obtained over time, and it takes patience to save enough for down payments on larger purchases or investments. However, capital can also be obtained by leveraging your overall assets that you have acquired through the years, assuming they have appreciated over time, and using those assets to garner cash to use for another investment opportunity. A home is an example of an asset that typically appreciates over time.

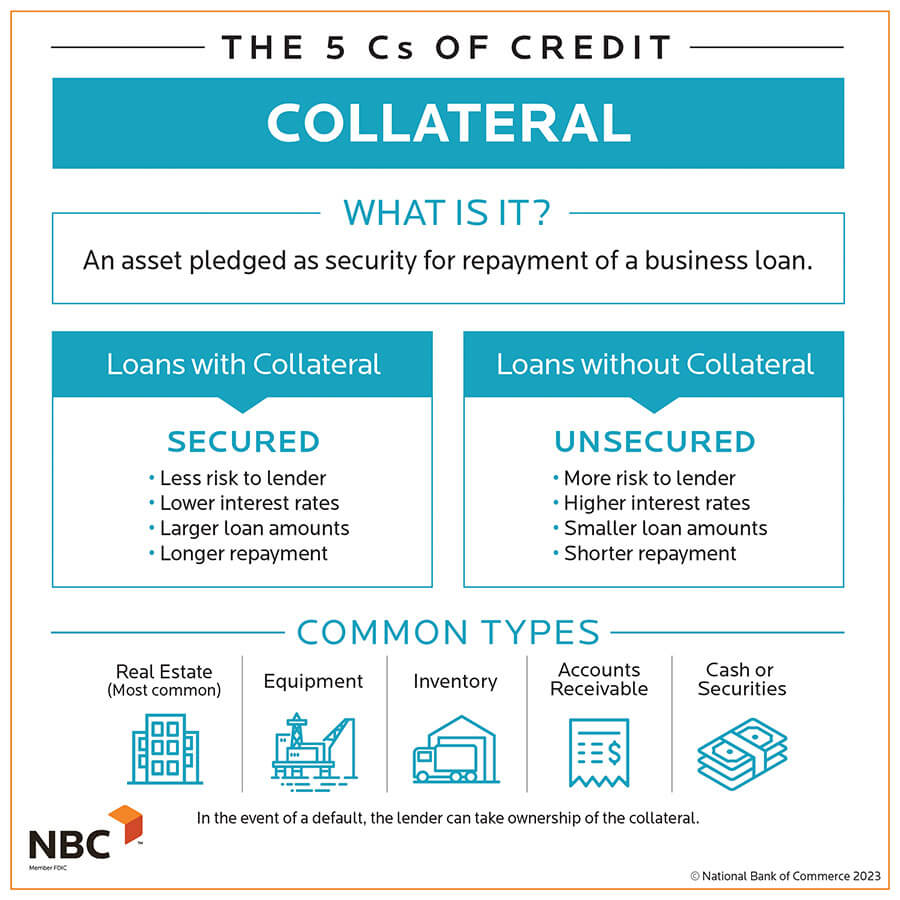

Collateral

What is Collateral?

Collateral is an asset pledged to a financial institution to assist a borrower in securing a loan. It gives the financial institution assurance that if the borrower were to default on the loan, then the financial institution can get something back by repossessing the collateral.

For example, if a borrower applies for an auto loan a financial institution will use the vehicle as collateral. Similarly, if a borrower applies for a home loan the financial institution will use the home as collateral.

The loans are referred to as secured loans, and they are less risky than unsecured loans. They allow for better rates and terms than an unsecured loan would be able to obtain. An unsecured loan is given when no collateral is attached to the loan.

Improving your collateral really depends on what type of collateral you have. For example, a home loan will usually appreciate with time, improvements to your property, and the decrease in debt owed on the property, improving your collateral.

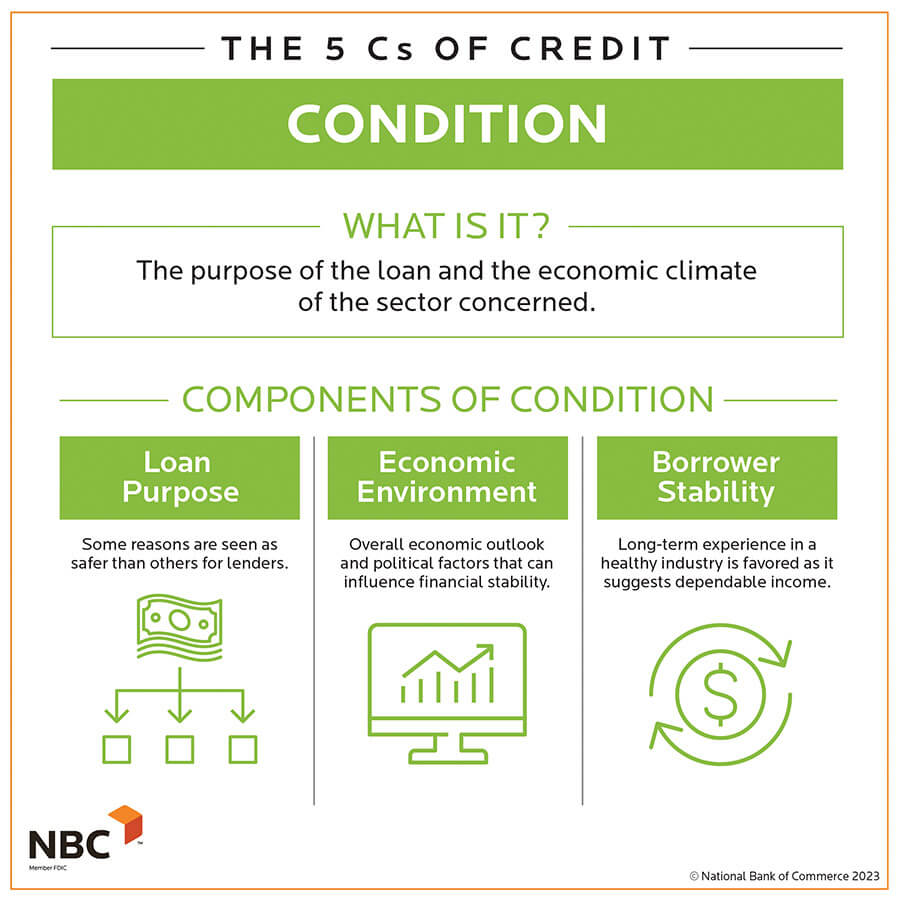

Condition

What is Condition?

Condition refers to the specific circumstances surrounding a loan application. These circumstances include the purpose for which the loan is sought, the broader economic environment, and the borrower’s stability in terms of experience and industry.

Conditions can also include how the borrower intends to use the money. For example, is the borrower using the funds for a home improvement project? Will the business loan provide improvements that aid in better future cash flow results? In both examples, the financial institution would look at economic indicators when reviewing these loan applications. Economic indicators are defined as a macroeconomic measurement used by analysts to understand current and future economic activity and opportunity. Both internal and external factors go into these criteria when determining the condition of a loan.

Conditions are the least likely of the five Cs to be able to be impacted by the borrower. Many conditions such as global and political macroeconomic conditions may not pertain to certain borrowers but rather all borrowers are facing the same level playing field. What a borrower can control is having a strong, solid reason for incurring the debt and being able to prove that they can afford the debt in their current and future financial position.

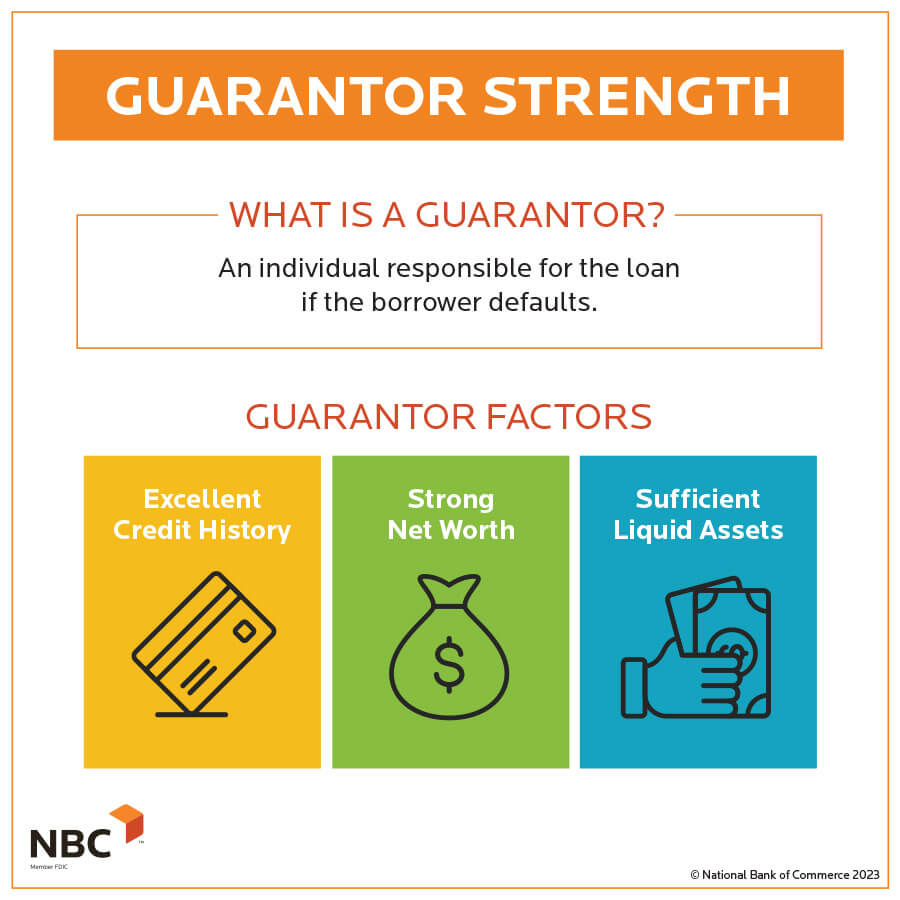

The G: Guarantor Strength

Here we come to that single G: guarantor strength.

What is a Guarantor?

A guarantor is an individual or entity that agrees to be responsible for repaying a loan if the primary borrower fails to do so.

When lending, financial institutions typically require guarantees from any owners of a business, home, or vehicle. This gives the financial institution additional confidence that if the borrower defaulted, they could still collect assets of the guarantor to replace the lost dollars that were borrowed.

What is Guarantor Strength?

A strong guarantor is one that exhibits excellent credit and sufficient income to cover the loan payments if a borrower were to default.

In the event of default, the financial institution can look to the guarantor’s assets to repay the loan in full. A guarantor’s obligation typically activates only after the lender has exhausted all means to collect from the primary borrower.

Improving the overall strength of a guarantor typically requires time and patience with a combination of building net worth and liquid assets, such as cash.

Learn about credit,

WATCH OUR VIDEO

Which Of These Are Most Important

Before applying for a loan, it’s important to understand all these factors, as each has intrinsic value. However, it’s worth noting that they aren’t strict guidelines. Different lenders prioritize certain factors over others, based on their risk tolerance.

At National Bank of Commerce, we look at all these aspects in some capacity when reviewing a loan, from current and future cash flows, personal credit history, condition of collateral, and the strength of the guarantor. They all play an important role when applying for a loan with NBC or any other financial institution for that matter.

» For more information about the business lending process, check out our Guide to Business Lending.