Types of Mortgage Loans

Learn about the most common mortgage types—whether you’re a first-time homebuyer, building, remodeling, consolidating debt, or refinancing.

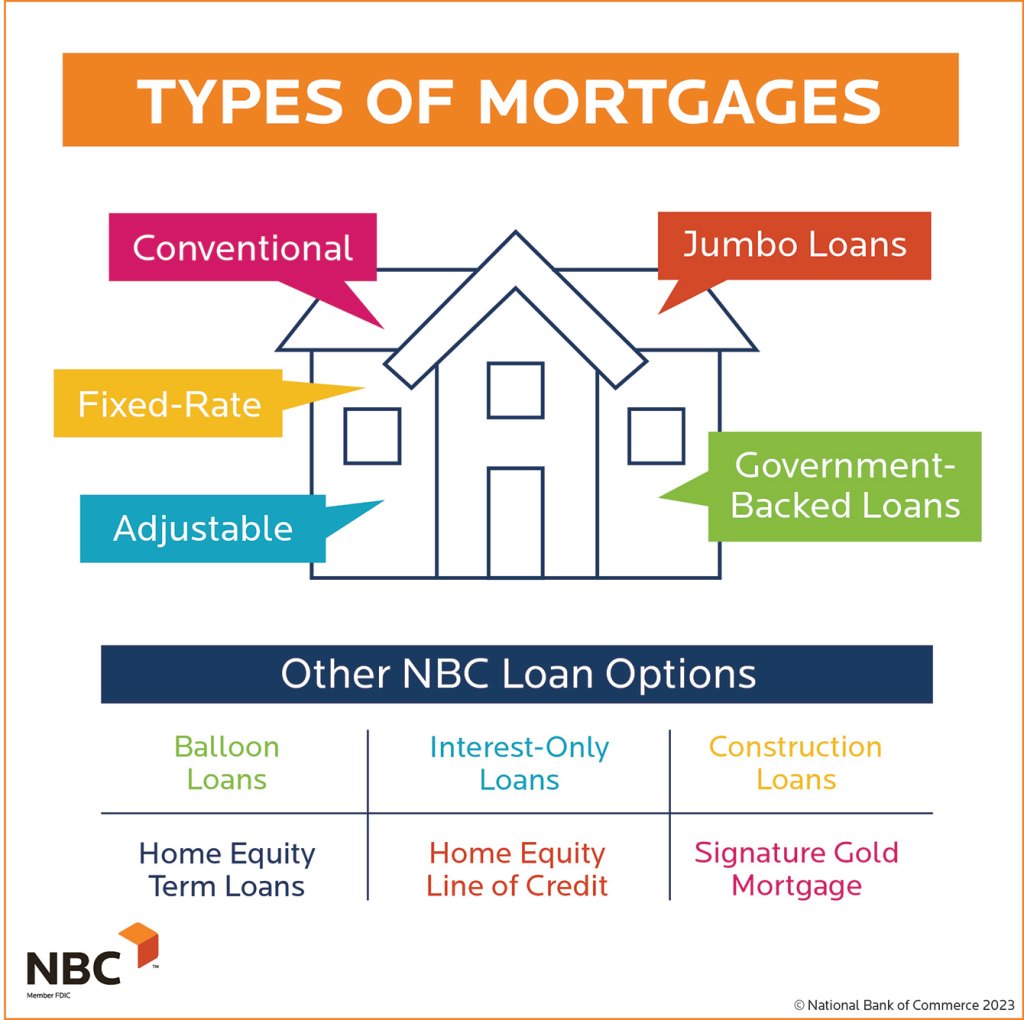

A variety of mortgage options exist, including conventional, fixed-rate and adjustable-rate mortgages, as well as government-backed and jumbo loans. The loan that will best suit your needs will depend on what you are looking to do. Some more common options are first-time home buyers, building a home, remodeling a home, consolidating debt, purchasing a new home, or refinancing to lower your rate.

Conventional Mortgages

Conventional mortgages are the most common type of mortgage. That said, conventional loans may have different requirements for a borrower’s minimum credit score and debt-to-income (DTI) ratio than other loan options.

Generally, you can qualify for a conventional mortgage with a minimum credit score of 620 and a DTI of up to 50%.

With a conventional mortgage, you can buy a home with as little as 3% down if you’re a first-time home buyer or if your qualifying income is considered low income as established by the U.S. Department of Housing and Urban Development (HUD).

If your income doesn’t qualify as low income, then a 5% down payment minimum is required. You’ll also need a minimum credit score of at least 620 to qualify.

You can skip buying private mortgage insurance (PMI) if you have a down payment of at least 20%. However, a down payment of less than 20% means you’ll need to pay for PMI. PMI protects the lender if you stop making payments on your loan. PMI rates are usually lower for conventional loans than other types of loans (like FHA loans).

Conventional loans are a good choice for most borrowers who want to take advantage of lower interest rates with a larger down payment.

Pros of Conventional Mortgages:

- The overall borrowing cost after fees and interest tends to be lower than other loan types.

- Your down payment can be as little as 3%–5% for qualifying loans.

Cons of Conventional Mortgages:

- You must pay PMI if the down payment is less than 20%.

- You’ll have to meet qualifications that may require a higher minimum credit score of 620 and lower DTI.

Home Buyers Who Might Benefit:

- Borrowers who can pay at least 3%–5% down and have a minimum FICO® Score of 620 can typically benefit from conventional loans.

- Borrowers with a DTI of 50% or less can typically benefit from conventional loans.

Fixed-Rate Mortgages

A fixed-rate mortgage has the same interest rate and principal/interest payment throughout the loan. The amount you pay per month may fluctuate due to changes in property tax and insurance rates, but for the most part, fixed-rate mortgages offer you a very predictable monthly payment.

A fixed-rate mortgage might be a good choice for you if you’re currently living in your “forever home.” A fixed interest rate gives you a better idea of how much you’ll pay each month for your mortgage payment, which can help you budget and plan for the long term.

Pros of Fixed-Rate Mortgages:

- Monthly principal and interest payments don’t change over the life of your loan, making it easier to plan and budget.

- Your loan is fully amortized over the term of the mortgage which means your payment will stay the same for the duration of the loan.

Cons of Fixed-Rate Mortgages:

- You’ll pay a higher rate than the introductory rate you could get on an adjustable-rate mortgage.

- You may end up paying more in interest over time if the rates are high.

Home Buyers Who Might Benefit:

- Fixed-rate loans are great for buyers who don’t want to have to worry about their monthly principal and interest payments changing down the road.

- Buyers who are purchasing or refinancing their forever home and don’t plan on moving anytime soon can benefit from these loans.

Adjustable-Rate Mortgages

Adjustable-rate mortgages (ARM) loans have fixed rate interest that is typically 3, 5, 7 or 10 years. A 5/1 ARM loan, for example, has a fixed rate for the first five years. After five years, your interest rate changes depending on the index used.

The index is a benchmark interest rate that reflects general market conditions, and the margin is a number set by your lender when you apply for your loan. The index and margin are added together to become your interest rate when your initial rate expires. Your rate will go up if the index’s rates go up. If they go down, your rate goes down.

ARMs include rate caps that dictate how much your interest rate can change in a given period and over the lifetime of your loan. Rate caps protect you from rapidly rising interest rates. For instance, interest rates might keep rising year after year, but when your loan hits its rate cap, your rate won’t continue to climb. These rate caps also go in the opposite direction and limit the amount that your interest rate can go down as well.

Pros of Adjustable-Rate Mortgages:

- They often offer lower interest rates for the initial introductory period.

- The initial low monthly payments allow for a more flexible budget.

Cons of Adjustable-Rate Mortgages:

- If the rate increases, it can increase your monthly payments once your fixed rate period is over.

- It’s more difficult to predict your financial standing if interest rates and mortgage payments fluctuate.

Home Buyers Who Might Benefit:

- Those who want a lower introductory rate while purchasing a starter home might benefit from an ARM.

- Those who don’t expect to live in their home for the full term of the loan could benefit from an ARM.

Government-Backed Loans

Government-backed loans are insured by government agencies, such as the Federal Housing Administration (FHA), Veterans Affairs (VA) or the United States Department of Agriculture (USDA). When lenders talk about government-backed loans, they’re referring to three types of loans: FHA, VA, and USDA loans.

Government-backed loans may offer more options for qualification. Each government-backed loan has specific criteria you need to meet to qualify along with unique benefits, but you may be able to save on interest or down payment requirements, depending on your eligibility.

FHA Loans

FHA loans are insured by the Federal Housing Administration. An FHA loan allows you to buy a home with a credit score as low as 580 and a down payment of 3.5%. With an FHA loan, you may be able to buy a home with a credit score as low as 500 if you pay at least 10% down.

USDA Loans

USDA loans are insured by the United States Department of Agriculture. USDA loans have lower mortgage insurance requirements than FHA loans and can allow you to buy a home with no money down. You must meet income requirements and buy a home in an eligible suburban or rural area to qualify for a USDA loan.

VA Loans

VA loans are insured by the Department of Veterans Affairs. A VA loan allows you to buy a home with zero dollars down and receive a lower interest rate than most other types of loans. You must meet service requirements in the Armed Forces or National Guard to qualify for a VA loan.

Pros of Government-Backed Loans:

- It’s possible to save on interest and down payments, which could mean reduced closing costs.

- These loans may offer wider qualification opportunities for borrowers.

Cons of Government-Backed Loans:

- You must meet specific criteria to qualify.

- Many types of government-backed loans have insurance premiums (also called funding fees) that are required upfront, which can result in higher borrowing costs.

Home Buyers Who Might Benefit:

- Those who have low cash savings might benefit from a government-backed loan.

- Those with lower credit could benefit from a government-backed loan.

Jumbo Loans

A loan is considered jumbo if the amount of the mortgage exceeds loan-servicing limits set by Fannie Mae and Freddie Mac—currently $726,200 for a single-family home in all states (except Hawaii and Alaska and a few federally designated high-cost markets, where the limit is $1,089,300).

Freddie Mac and Fannie Mae are both creative acronyms for congressionally created home mortgage companies. The Federal Home Loan Mortgage Corp. became Freddie Mac and the Federal National Mortgage Association became Fannie Mae.

Pros of Jumbo Loans:

- Their interest rates are like conforming loan interest rates.

- You can borrow more for a more expensive home.

Cons of Jumbo Loans:

- Qualification for a jumbo loan typically requires a credit score of 700 or higher, more money for a down payment and/or cash reserves, and a lower DTI ratio than other loan options.

- You’ll need a large down payment, typically between 10%–20%.

Home Buyers Who Might Benefit:

- Those who need a loan larger than $726,200 for a high-end home, have a good credit score and low DTI.

Other NBC Mortgage Options:

- Balloon Loans

- Interest-Only Loans

- Construction Loans

- Home Equity Term Loans

- Home Equity Line of Credit (HELOC)

- Signature Gold Mortgage

Balloon Loans

A balloon loan is a mortgage that operates on a lump-sum payment schedule. This means that at some point in the life of your loan, usually at the end, you’ll have to pay the remainder of the balance at once.

Depending on your lender, you may pay only interest for the life of your loan and make one big principal payment at the end, or a combination of interest and principal, with a somewhat smaller lump-sum payment at the end.

With a balloon loan, you’ll have low monthly payments and the ability to use your money for other things, such as building credit or savings, before making your eventual lump-sum payment.

These loans can be a good idea for homeowners who know they won’t be in a house very long or for homeowners who can pay the lump sum amount quickly to avoid having mortgage payments in the long run.

Interest-Only Loans

An interest-only mortgage is like some balloon loans in that it may allow a borrower to only pay interest on the loan for their monthly payment rather than interest and principal. Unlike a balloon loan, however, interest-only mortgages usually only allow you to pay interest-only for a set number of years. After that, your monthly payment starts to include principal, which will increase your monthly payment.

Most interest-only loans are ARMs, meaning your interest rate on the loan will be adjusted some number of times each year based on the current rates, causing your monthly payments to go up or down.

These loans are often structured in the format of “5/6,” with the 5 being the number of years you’d pay only interest and the 6 indicating that your rate will be adjusted every 6 months.

There are interest-only fixed-rate mortgages as well, but they are very rare.

ARMs can be more expensive long-term, so if a rate that is guaranteed not to increase sounds better to you, you may instead want to refinance to a conventional fixed-rate loan.

Construction Loans

A construction loan is a short-term loan that covers the costs of building or rehabilitating a home. It is different, however, than a traditional loan where you make monthly payments of principal and interest.

Construction loans are structured like lines of credit—you will draw funds from the loan to pay contractors for their work and make interest-only payments during the building phase. When your home is complete, you will pay off the temporary construction loan with a long-term mortgage loan, typically a conventional loan.

Home Equity Term Loans

A home equity loan—also known as an equity loan, home equity installment loan, or second mortgage—is a type of consumer debt. Home equity loans allow homeowners to borrow against the equity in their homes.

The loan amount is based on the difference between the home’s current market value and the homeowner’s mortgage balance due.

Home equity loans tend to be fixed rate, while the typical alternative, home equity lines of credit (HELOCs), generally have variable rates.

Home Equity Lines of Credit (HELOC)

A home equity line of credit, also known as a HELOC, is a line of credit secured by your home that gives you a revolving credit line to use for large expenses or to consolidate higher-interest rate debt on other loans such as credit cards.

A HELOC often has a lower interest rate than some other common types of loans, and the interest may be tax deductible.

With a HELOC, you’re borrowing against the available equity in your home and the house is used as collateral for the line of credit. As you repay your outstanding balance, the amount of available credit is replenished—much like a credit card.

This means you can borrow against it again if you need to, and you can borrow as little or as much as you need throughout your draw period (typically 10 years) up to the credit limit you establish at closing. At the end of the draw period, the repayment period (typically 20 years) begins.

NBC Signature Gold Mortgage

National Bank of Commerce’s Signature Gold Mortgage is available for customers with $240,000+ in combined household adjustable gross income, or $500,000+ in verified investable assets, or $1,000,000+ in net worth.

This loan is for single-family primary residences and second homes. This can be used for purchases or refinances. Minimum credit score of 700 is required.

Up to 100% of purchase price or appraised value (whichever is less) is available for loan amounts up to and including $1,000,000. Up to 95% of purchase price or appraised value (whichever is less) is available for loan amounts over $1,000,000 and up to and including $1,500,000.

Private Mortgage Insurance (PMI) is not required for this product. An active NBC checking account with a qualified direct deposit is required to qualify as well.

Biggest Piece of Advice

My biggest piece of advice is to consult an experienced local mortgage banker. They will know what programs or mortgages could save you the most money or aid in loan approval. They will also have the knowledge of what is required in their area and often have other options to help their customers.

Other Articles in this Guide

What is a Mortgage?

Learn about the components of a mortgage, who is involved, and gain clarity on this major milestone in your life.

How Much Can I Afford?

Learn how to qualify and determine how much you can afford. Your dream home may be closer than you think!

Mortgage Loan Process

Learn how getting a mortgage loan works and take the first step to financing for your dream home in as little as just 30 days.